On July 21, the House Committee on Education and Labor began marking up a bill, introduced by Rep. George Miller, D-Calif., that seeks to eliminate government-subsidized private student lending and replace it with direct loans to students through the Department of Education.About damn time. Private-lender student loans are one of the worst deals one can get into when paying for education. I had to take out just one private loan - to cover BARBRI and summer school. The interest rate is 3% points higher than my federal loans. When I was unemployed for 6 months following graduation, all it took was a a short form and a signature to get my federal loans deferred. For my private loans, the best Sallie Mae could offer was a 3 month forebearance for a $50 fee."This is the biggest change in federal loans for higher education since 1965, when the original program was created," says Terry Hartle, senior vice president at the American Council on Education.

I had better help from my credit card companies during my unemployment period. The private loan provides, like Sallie Mae and NelNet, use the student loan protections (non-dischargeability in bankruptcy, ease to obtain, and relatively low interest rates) to hook students, who in a lot of cases have the choice of an a private loan or no education, if they don't satisfy the FAFSA requirements. Then, they can use their own policies to fiddle with the interest rates, charge late fees, and have tough deferment/forbearance/forgiveness policies. They aren't even eligible for the Income Contingent Repayment options or the federal loan forgiveness programs for public service. And you can't consolidate them through the federal loan consolidation programs.

So, to recap - all the drawbacks for the borrower, and none of the risks for the creditor.

Letting the Fed handle student loans just makes sense - their Direct Loan program is great ($93,000 @ $370 a month @ 4.75% fixed, thanks to consolidation) for students, generates a minimal but still positive return for the government (i.e., it more or less pays for itself eventually), and can provide huge benefits by encouraging public service through forgiveness programs. And it lets students pick occupations that require major education but have minimal income, with ICR options that forgive the loans after 20 years of repayment.

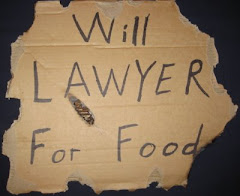

In conclusion, here's to Sallie Mae - and to the hope that you die unloved, unmourned, and soon to be forgotten. And keep cashing my $200 a month checks.

.jpg)

good student loan article.

ReplyDeletepaying back student loans