"More than 126,000 consumers filed for bankruptcy in the U.S. last month, 34 percent more than in July 2008, the ABI said in its latest report on Aug. 4. The increase came after a 36.5 percent rise in personal bankruptcies nationwide in the first six months, to 675,351, according to the ABI research group, which interprets data collected by the National Bankruptcy Research Center."and:

"Credit Card LossesJPMorgan said losses in its Chase credit-card portfolio may be 10 percent next quarter and will be “highly dependent” on unemployment after that. Losses for cards issued by Washington Mutual, which the bank acquired in September, may reach 24 percent by the end of the year, the company said.

JPMorgan’s credit cards lost $672 million, compared with income of $250 million in the second quarter last year. Home- equity charge-offs climbed to $1.3 billion, or 4.61 percent. Prime mortgage defaults rose to $481 million, or 3.07 percent, from $104 million, or 1.08 percent a year earlier."

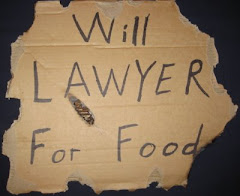

Too bad the article failes to mention how Chase and most of the other lenders are at least partially, and often majorly, responsible for the bankruptcies themselves. Time and again I get client whose almost sole reason for filing bankruptcy is their credit card rates getting jack to 30%. I have seen debtors who have struggled along for years, through unemployment and famine, after tapping their 401(k)'s and IRA's dry, just to make their minimum payments. Then they watch their minimum payments triple and their interest rates quadruple.

Chase could very well be posting profits, or at least much smaller losses, if it had left the interest rates and minimum payments where they were. Instead, the screw around and drop some more straw on the camel's back, and the next step is a visit to my office.

Thank you Chase; you are one of the best feeders for my services. I love nothing better than adding you to Schedule F with a big fat 5 or 6 figure number in the amount column. You bring it down upon yourself by biting too hard on the teat of the honest but unfortunate debtor.

They even cut my limit and boosted my rate, after I paid off my balance from college. I was using the card for gasoline and whatnot, paying it off every month, and they cut my limit, 6 months after I paid off my $2,000 college indiscretion balance. I was only using it to keep it active and boost my credit score. Their reason: "Not paying bankcards as agreed," despite the fact that my balances are minimal and my monthly payments are quadruple the minimums.

Now? I'll just let it languish with a zero balance until they close it. I'll stick with my Sears Mastercard (they keep bumping my limit) and my credit union credit card (I love my credit union too) - the folks that actually treat me right.

The horrible downside is that, in the next few years, we'll see another bankruptcy reform act, which will further tighten the screws on the already completely-screwed, force more people into nearly impossible Ch. 13 repayment plans (100% of my disposable income for five years? God forbid I need a new alternator), all on the justification that too many debtors are filing bankruptcy after Chase (and others) gave them too much credit, and then turned around and screwed them by jacking the rates and payments.

.jpg)

No comments:

Post a Comment