My last post was a bit of a client-rant; I should clarify a little. Not all clients are unpleasant. Some are very understanding, very helpful, and generally on top of things. Consumer bankruptcy requires very little on the part of the debtors - some pay stubs, some tax returns, a couple of credit counseling classes, and occasionally a market analysis or appraisal.

Some clients come prepared - printouts, spreadsheets, credit reports, paystubs, taxes, and tons of other information. These are my favorite clients. Their efforts make my life easier and makes their bankruptcy run all the smoother.

Others have no idea what their financial situation is, and more often than not they blame us for that lack of knowledge.

Some clients understand that I have 10 files on my desk, all of which need attention, and that they are #11. Others expect to be dealt with immediately, even for small things of little or no consequence.

Today, I sent out the discharge papers for one of my favorite clients, one of the early good ones. It makes me a little sad, in a way: no more patient explanations of the mysteries of the bankruptcy code, no more thoughtful questions, and nothing further with a good guy who ran into some terrible financial difficulties.

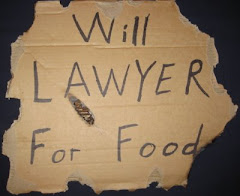

Bankruptcy is ultimately a transient operation; almost no repeat business, and a constant need for new clients. Each month we open 60 to 100 new files, and close almost as many. Sixty new people, starting their short transition though my sphere of responsibility, and 60 more passing on into the wild green yonder of post-bankruptcy life.

Reflections

9 months ago

.jpg)

No comments:

Post a Comment