This week, I was working on a Reaffirmation Agreement. A Reaffirmation Agreement basically extends a contract through a bankruptcy. In Chapter 7, the bankruptcy discharge is very broad, and it will sever almost all obligations, include auto loans. In order to keep a car that one is making payments on in Chapter 7, a debtor has to Reaffirm the debt. By Reaffirming, the debtor is taking on all the obligations and risks of the contract, including liability if the vehicle is repossessed.

The Reaffirmation Agreement in question was with Chrysler Financial. The interest rate was a usury-level 23%, so I contacted the creditor to attempt to negotiate a lower rate. After all, if the debtor doesn't reaffirm, the creditor will just take the car back and notch a big fat loss in their ledger. The response: "Chrysler Financial does not negotiate on reaffirmation agreements."

F*ck you Chrysler. (I do realize that Chrysler Financial and Chrysler the auto company are different, but *vent rage*).

Bailout funds + Chapter 11 and you won't negotiate? I wish your bond holders had liquidated you. I wish they had said "We don't negotiate" and drove you to Chapter 7. Their stance only makes sense if they presume a debtor needs/wants the car. At 23% interest, my recommendation was to dump it; a Buy Here/Pay Here place would charge them the same, or perhaps even less in interest. Sadly, the debtor wants to keep it. Personally, I would have told Chrysler where to stick it.

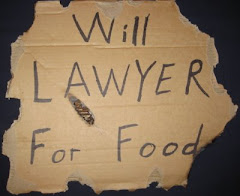

I hate creditors, especially when they are simply patently unreasonable.

Reflections

9 months ago

.jpg)

No comments:

Post a Comment