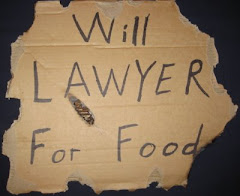

Alternative title: Stupid Creditors

Today I started work on yet another motion for sanctions for violations of the automatic stay. For those unfamiliar with the intimacies of bankruptcy law, the primary protection that bankruptcy provides is the Automatic Stay, 11 U.S.C. 362. Under Section 362, once a debtor files for bankruptcy, creditors are prohibited from taking basically any collection action against them. That code section triggers automatically - and it is powerful. It will stop foreclosures, repossession, creditor calls, lawsuits, garnishments . . . basically every sort of collection activity.

Violation of the stay is pretty egregious. One case involved a car dealer who repossessed a vehicle despite having sufficient notice of the bankruptcy. Others involve creditors continuing to place collection calls and so forth.

As an attorney, I understand that things can slip through the cracks. The first step is almost always a letter, fax, or phone call to let the creditor know that is going on. In most cases, they are quick to acknowledge the issue and cease their actions.

My favorites are the ones that don't. Sanction awards for continuing violation of the stay can be pretty harsh. Awards of attorney's fees and even punitive damages are common. I am definitely looking forward to the results of these motions. Most of the time debtors are on the losing side - so payback can be a b!tch.

Lyorn Discussion–Major Spoilers

3 weeks ago

.jpg)